R&D tax credits explained

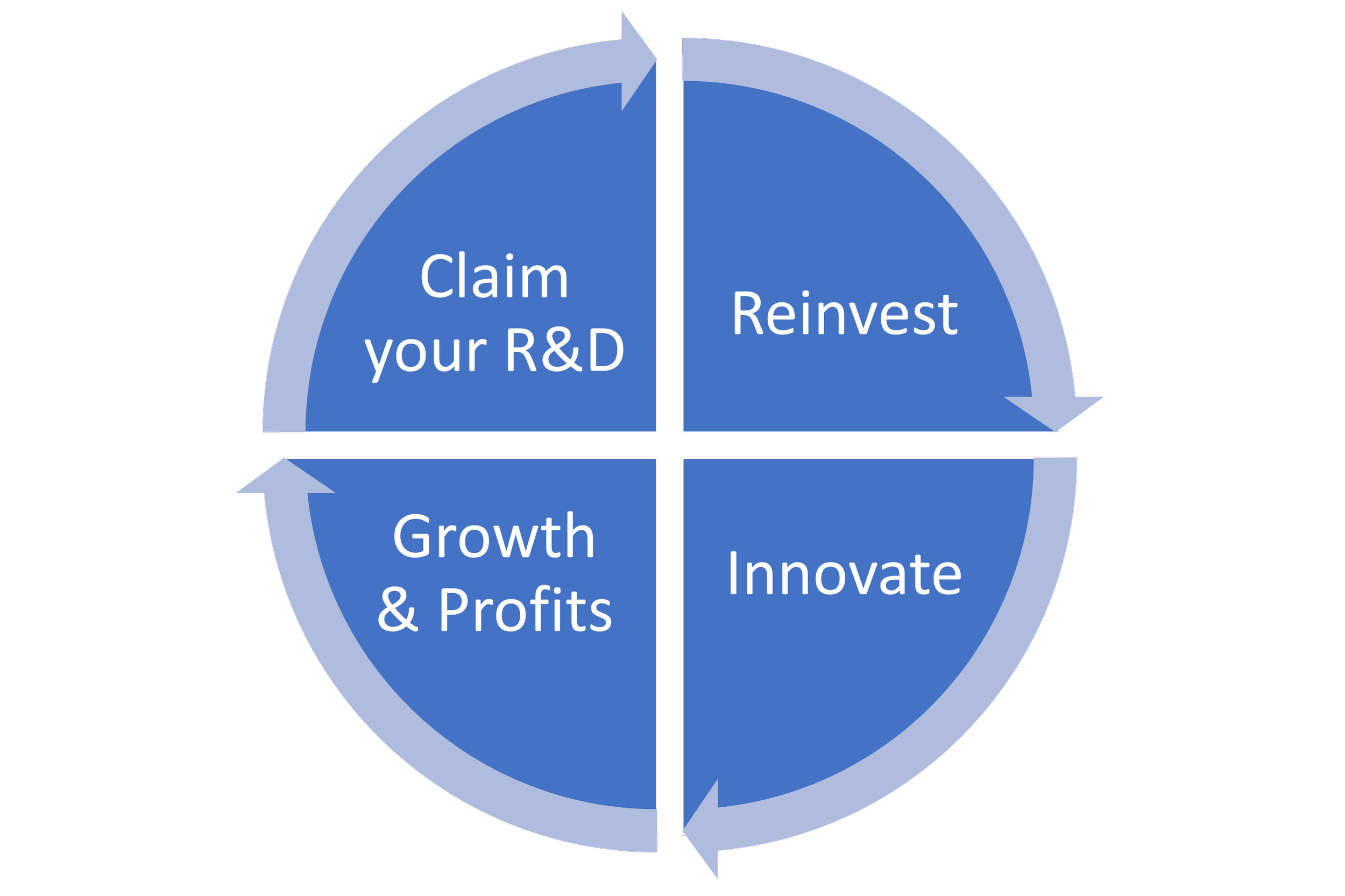

R&D Tax Credits are breathing new life into businesses by rewarding innovation and growth.

What are R&D tax credits?

Research and development (R&D) tax credits are a government incentive designed to reward UK companies for investing in innovation. They are a valuable source of cash for businesses to invest in accelerating their R&D, hiring new staff and ultimately growing.

How do R&D tax credits work?

Companies that spend money developing new products, processes or services; or enhancing existing ones, are eligible for R&D tax relief. If you’re spending money on your innovation, you can make an R&D tax credit claim to receive either a cash payment or a reduction in corporation tax. The scope for identifying R&D is huge – in fact, it exists in every single sector. And if you’re making a claim for the first time, you can typically claim R&D tax relief for your last two completed accounting periods.

What counts as R&D?

Creating new products, processes or services.

Changing or modifying an existing product, process or service.

If you’re not sure if your project is possible, or you don’t know how to achieve it in practice, you could be resolving technological uncertainties and be carrying out qualifying R&D.

Within the government’s accepted research and development definition, R&D doesn’t have to have been successful to qualify. For more information on qualifying activities and to see how much you could be owed, use the form below to get in touch.